Over the past decade, Portugal has attracted a growing number of new residents. Retirees in search of quality of life, families looking for a safe and peaceful environment, entrepreneurs motivated by favorable taxation, freelancers drawn by the climate, and digital nomads seeking a southern European base — all find in Portugal a rare sense of balance.

Almost constant sunshine, prices still affordable compared to other European capitals, safety, quality of life, rich traditions, and warm hospitality: there are countless reasons why Portugal has become one of the most popular destinations for expatriates.

However, moving to another country requires preparation. To turn this dream into reality, several administrative, fiscal, banking, and practical steps must be followed. This guide provides a complete, step-by-step overview to help you settle successfully.

1. Prepare your move before leaving

Relocating abroad requires careful planning. Before starting the administrative process, it’s important to:

- Define your goal: retirement, employment, entrepreneurship, study, or remote work — each involves specific requirements.

- Choose your city or region: Lisbon and Porto offer professional and cultural opportunities; the Algarve is known for its climate; the North for its authenticity; and the Azores or Madeira for their natural beauty.

- Estimate your budget: housing, insurance, schooling, and local taxes.

- Reach out to expat associations or online communities for advice and first-hand experiences.

A well-prepared project helps avoid unpleasant surprises once you arrive.

2. The NIF: your first essential step

The very first administrative step in Portugal is obtaining a NIF (Número de Identificação Fiscal), the Portuguese tax identification number.

Why it’s essential:

The NIF is required for nearly all official transactions, such as:

- Renting or buying property.

- Opening a bank account.

- Signing an employment contract.

- Accessing public services.

- Filing taxes.

How to get it:

- Apply in person at a Finanças office (Portuguese tax authority).

- Required documents: passport or ID card, and proof of address.

- Non-residents must appoint a tax representative residing in Portugal.

The NIF is usually issued immediately on site.

3. Legal residence

EU citizens

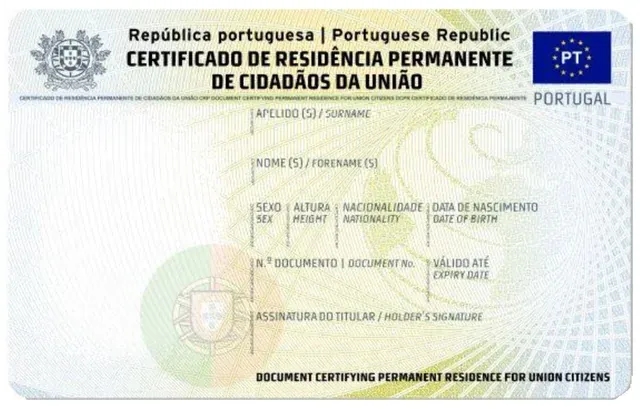

EU citizens benefit from freedom of movement. However, for stays longer than 90 days, it is necessary to apply for a Certificate of Registration for EU Citizens (CRUE).

- Where: at the City Hall (Câmara Municipal) of your residence area.

- Required documents: passport or ID card, proof of income or employment, and proof of address.

- The certificate is valid for five years.

Non-EU citizens

The process is more complex:

- A long-stay visa or residence permit is required, depending on the reason (work, study, family reunification, investment).

- Residence permits are issued by the SEF (Serviço de Estrangeiros e Fronteiras).

4. Taxes and favorable regimes

Portugal’s tax system is one of its main attractions.

Standard taxation

Anyone residing in Portugal for more than 183 days per year is considered a tax resident and is taxed on worldwide income.

NHR (Non-Habitual Resident) regime

- Valid for 10 years.

- Open to individuals who have not been tax residents in Portugal for the previous 5 years.

- Benefits: some foreign pensions taxed at 10%, and income from high-value professions taxed at a flat rate of 20%.

This regime has made Portugal particularly appealing to European retirees and skilled professionals.

Tax declaration

The annual income declaration (IRS) is submitted online via the Portal das Finanças. Your NIF is therefore indispensable.

5. Opening a bank account

While not mandatory, it is highly recommended to open a Portuguese bank account to manage daily expenses.

- Required documents: NIF, ID, proof of address, and sometimes proof of income.

- Main banks: Caixa Geral de Depósitos, Millennium BCP, Novo Banco, Santander Totta.

- Some digital banks allow online account opening, though local institutions remain preferred for administrative procedures.

6. Housing: rent or buy?

Renting

- Written rental contracts are mandatory and must be registered with the tax authorities.

- Security deposit: typically 1–2 months’ rent.

- Required documents: NIF, ID, and often proof of income.

Rental prices have risen in Lisbon and Porto, but remain lower than in Paris or London.

Buying

Portugal remains attractive for property investment.

Steps: obtain a NIF, open a bank account, sign the preliminary purchase agreement, and finalize the deed with a notary.

Transaction costs (notary, taxes, and fees) generally amount to 7–10% of the property value.

7. Health and social protection

SNS (Serviço Nacional de Saúde)

Residents can register with Portugal’s public health system.

- Register at your local health center with your NIF, CRUE, and proof of address.

- Services are either free or very low-cost.

Private health insurance

Many expats choose private insurance to reduce waiting times and access private clinics.

European Health Insurance Card (EHIC)

For EU citizens, this card covers initial medical care during the transition period.

8. Working or starting a business

Employment

To work in Portugal, you must have:

- A valid employment contract.

- Registration with Social Security (NISS).

Self-employment

Freelancers must register with the tax authorities and social security. Social contributions are proportional to declared income.

Starting a business

The Empresa na Hora program allows you to create a company in a single day, complete with a tax number and business registration.

9. Education and family life

Public schools

Free and open to all resident children. Classes are taught in Portuguese.

Private and international schools

Lisbon, Porto, and the Algarve offer many international schools teaching in English, French, or German. Annual tuition fees range from €5,000 to €20,000.

Childcare

There are public and private nurseries, as well as licensed childminders. Early registration is strongly advised in major cities.

10. Learning the language and integrating

Learning Portuguese greatly facilitates integration.

- Courses are offered through community centers, universities, and private schools.

- Although many Portuguese speak English, the effort to learn the language is always appreciated.

Taking part in local life — neighborhood events, cultural associations, volunteering — is another great way to integrate.

11. Daily life: practical tips

- Transport: metro and bus networks in Lisbon and Porto, reliable train connections between main cities. A car is useful in rural areas.

- Climate: plenty of sunshine, but higher humidity in the North.

- Cost of living: lower than in France, though housing prices are rising.

- Safety: Portugal is considered one of the safest countries in Europe.

Conclusion

Settling in Portugal is a rewarding adventure that requires preparation and method. From obtaining your NIF to registering for healthcare, finding housing, or enrolling your children in school, each step is crucial for a smooth transition.

Portugal is not just a place with a high quality of life — it’s a country that harmoniously blends tradition and modernity, economic opportunity and Mediterranean charm. For newcomers, it offers a true second home — provided the move is made with organization and patience.

Share this article

Suggested articles

Cultural Differences Between France and Portugal in Everyday Life

France and Portugal share a long common history built on respect and friendship. But living between the two countries means discovering how much small habits, ways of speaking, or daily routines differ. These cultural nuances, sometimes amusing, sometimes surprising, reveal a lot about the character of both peoples. Between lifestyle, communication, cuisine, family, or work, this is a journey into the heart of the French-Portuguese differences that make this relationship so rich.

Buy or Rent in Portugal: Which Housing Choice?

Portugal continues to attract: mild climate, vibrant culture, sunny gastronomy, and a relaxed pace of life. But when the time comes to settle or invest, one big question arises: should you buy or rent? The choice of housing, often emotional, becomes here a truly strategic decision. This guide helps you understand the differences, weigh the advantages, and choose the solution that best suits your project.

Truly Integrating into Portugal: Understanding the Local Mentality

There are countries where you arrive, unpack your bags, learn three words of the language, and think, “I’m integrated.” Portugal isn’t that kind of country. Here, integration isn’t about ticking boxes. It’s a slow conquest, a story of listening, of observation, of small gestures, and above all, of humility.

The Cost of Living in Portugal in 2025: Between Reality and Myth

For years, Portugal had that image of a small sunny paradise, where life cost almost nothing, where you could live like a king on a modest salary, and where retirees from Northern Europe came to settle down to “enjoy life.”

Mistakes to avoid when moving to Portugal

It’s a common mistake: imagining that moving to Portugal means leaving all modern life’s problems behind. The country may be welcoming, stable and warm, but it’s still a European nation with its own challenges.

Living in Portugal without speaking Portuguese myth or reality

Portugal is one of those rare countries where you can arrive without feeling completely lost. Young people speak English fluently, waiters switch easily between several languages, and even in public offices there’s almost always someone ready to help in French or Spanish. It’s not a myth: the Portuguese have a real talent for languages and, above all, they never make you feel bad for not speaking theirs.